Description:

Wiley & Sons, Incorporated, John. Used - Good. Used book that is in clean, average condition without any missing pages.

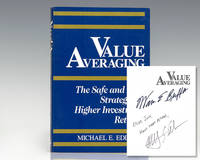

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns. by Edleson, Michael E. (Warren E. Buffett) - 1991

by Edleson, Michael E. (Warren E. Buffett)

Similar copies are shown below.

Similar copies are shown to the right.

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns.

by Edleson, Michael E. (Warren E. Buffett)

- Used

- Signed

- first

Chicago: International Publishing Corporation, 1991. First edition of this work which evolved out of Edleson's 1988 article which first introduced his concept of value averaging to the world. Octavo, original glossy wrappers. Inscribed by the author on the half-title page, "Dear John, Many Happy Returns, Michael E. Edleson." Additionally signed by Warren Buffett, "Warren E. Buffett." Like Edleson, American business magnate Warren E. Buffett developed his own innovative investment strategies based on the concept of value investing which he shared in several papers, essays and books. In near fine condition. Rare and desirable signed by both Edleson and Buffett. In Value Investing, Michale E. Edleson describes in detail his innovative investment strategy that addresses the age-old problem all investors face: how to "buy low" and then "sell high" to build real wealth easily and consistently over time. "Since its first printing in 1991, the cachet of Value Averaging has steadily grown to cult classic status" (William J. Bernstein).

-

Bookseller

Raptis Rare Books

(US)

- Book Condition Used

- Publisher International Publishing Corporation

- Place of Publication Chicago

- Date Published 1991

- Keywords Value Averaging: The Safe and Easy Strategy for Higher Investment Returns First Edition

We have 19 copies available starting at SGD 9.94.

Stock Photo: Cover May Be Different

Value Averaging : The Safe and Easy Strategy for Higher Investment Returns

by Edleson, Michael E

- Used

- Condition

- Used - Good

- ISBN 13

- 9780470049778

- ISBN 10

- 0470049774

- Quantity Available

- 2

- Seller

-

Mishawaka, Indiana, United States

- Item Price

-

SGD 9.94

Show Details

Item Price

SGD 9.94

Value Averaging : The Safe and Easy Strategy for Higher Investment Returns

by Michael E. Edleson

- Used

- good

- Paperback

- Condition

- Used - Good

- Binding

- Paperback

- ISBN 13

- 9780942641271

- ISBN 10

- 0942641272

- Quantity Available

- 1

- Seller

-

Seattle, Washington, United States

- Item Price

-

SGD 12.73

Show Details

Description:

International Publishing, 1991. Paperback. Good. Pages can have notes/highlighting. Spine may show signs of wear. ~ ThriftBooks: Read More, Spend Less.Dust jacket quality is not guaranteed.

Item Price

SGD 12.73

Stock Photo: Cover May Be Different

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns

by Edleson, Michael E

- Used

- Condition

- UsedLikeNew

- ISBN 13

- 9780470049778

- ISBN 10

- 0470049774

- Quantity Available

- 1

- Seller

-

King of prussia pa, Pennsylvania, United States

- Item Price

-

SGD 8.76

Show Details

Description:

UsedLikeNew. Book is in pristine condition, will not show signs of use. Used books may not contain supplements such as access codes, CDs, etc. Every item ships the same or next business day with tracking number emailed to you.

Item Price

SGD 8.76

Stock Photo: Cover May Be Different

Value Averaging : The Safe and Easy Strategy for Higher Investment Returns

by Edleson, Michael E

- Used

- Condition

- Used - Good

- ISBN 13

- 9780942641479

- ISBN 10

- 0942641477

- Quantity Available

- 1

- Seller

-

Mishawaka, Indiana, United States

- Item Price

-

SGD 16.18

Show Details

Description:

International Publishing. Used - Good. Used book that is in clean, average condition without any missing pages.

Item Price

SGD 16.18

Stock Photo: Cover May Be Different

Value Averaging : The Safe and Easy Strategy for Higher Investment Returns

by Edleson, Michael E

- Used

- Condition

- Used - Very Good

- ISBN 13

- 9780942641479

- ISBN 10

- 0942641477

- Quantity Available

- 1

- Seller

-

Mishawaka, Indiana, United States

- Item Price

-

SGD 16.18

Show Details

Description:

International Publishing. Used - Very Good. Used book that is in excellent condition. May show signs of wear or have minor defects.

Item Price

SGD 16.18

Value Averaging : The Safe and Easy Strategy for Higher Investment Returns

by Michael E. Edleson

- Used

- good

- Paperback

- Condition

- Used - Good

- Binding

- Paperback

- ISBN 13

- 9780942641479

- ISBN 10

- 0942641477

- Quantity Available

- 1

- Seller

-

Seattle, Washington, United States

- Item Price

-

SGD 16.51

Show Details

Description:

International Publishing, 1993. Paperback. Good. Pages can have notes/highlighting. Spine may show signs of wear. ~ ThriftBooks: Read More, Spend Less.Dust jacket quality is not guaranteed.

Item Price

SGD 16.51

Stock Photo: Cover May Be Different

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns

by Michael E. Edleson

- Used

- good

- Paperback

- Condition

- Used - Good

- Binding

- Paperback

- ISBN 13

- 9780942641479

- ISBN 10

- 0942641477

- Quantity Available

- 1

- Seller

-

HOUSTON, Texas, United States

- Item Price

-

SGD 21.46

Show Details

Description:

Intl Pub Corp, 1993-05. Paperback. Good.

Item Price

SGD 21.46

Stock Photo: Cover May Be Different

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns

by Edleson, Michael E

- New

- Condition

- New

- ISBN 13

- 9780470049778

- ISBN 10

- 0470049774

- Quantity Available

- 40

- Seller

-

Benton Harbor, Michigan, United States

- Item Price

-

SGD 23.45

Show Details

Description:

Wiley. New. BRAND NEW, GIFT QUALITY! NOT OVERSTOCKS OR MARKED UP REMAINDERS! DIRECT FROM THE PUBLISHER!

Item Price

SGD 23.45

Value averaging: The safe and easy strategy for higher investment returns

by Michael E Edleson

- Used

- good

- Paperback

- Condition

- Used - Good

- Binding

- Paperback

- ISBN 13

- 9780942641271

- ISBN 10

- 0942641272

- Quantity Available

- 1

- Seller

-

HOUSTON, Texas, United States

- Item Price

-

SGD 30.79

Show Details

Description:

International Pub. Corp, 1991. Paperback. Good.

Item Price

SGD 30.79

Value Averaging: The Safe and Easy Strategy for Higher Investment Returns: 35 (Wiley Investment Classics)

by Edleson, Michael E

- Used

- very good

- Paperback

- Condition

- Used - Very Good

- Binding

- Paperback

- ISBN 13

- 9780470049778

- ISBN 10

- 0470049774

- Quantity Available

- 2

- Seller

-

GORING BY SEA, West Sussex, United Kingdom

- Item Price

-

SGD 20.34

Show Details

Description:

Paperback. Very Good.

Item Price

SGD 20.34